Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s (BTC) price, with $90,000 in sight. Global and regional liquidity is expanding, a trend that has historically proven bullish for risk assets like crypto.

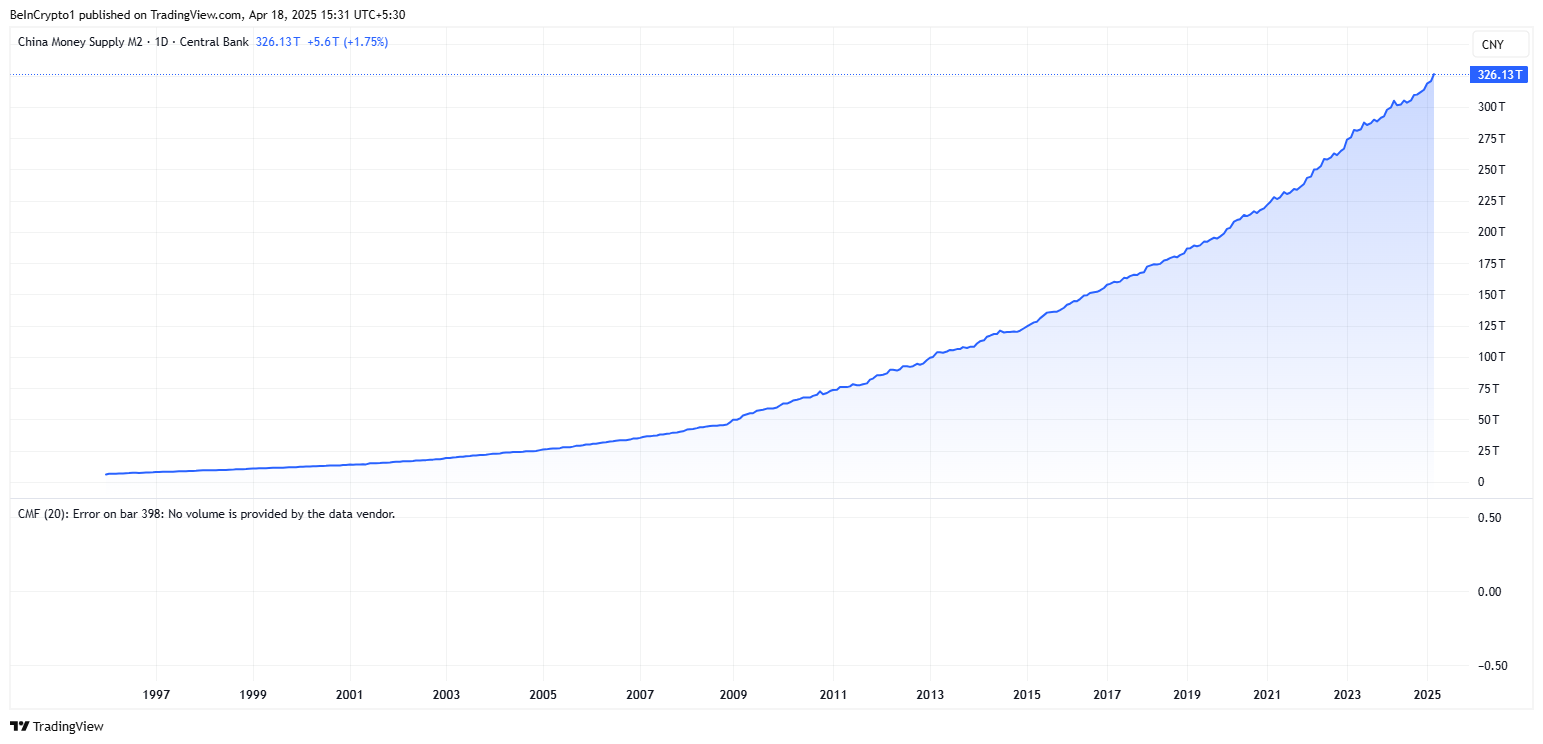

Will Bitcoin Follow As China’s M2 Money Supply Rises?

According to data on TradingView, China’s M2 money supply has reached a record $326.13 trillion, steadily surging to new record highs.

A rise in M2 signals greater liquidity in the financial system, suggesting more money is often seeking returns in riskier assets like Bitcoin and altcoins or others, such as equities and real estate.

“China’s M2 money supply just hit 326 trillion. The money printers are back on. Risk assets are about to go parabolic.,” analyst Kong Trading remarked.

Data on BGeometrics show that the global M2 is rising, a trend similar to that seen in China’s M2 money supply. Recent spikes have taken both metrics to their respective peaks.

Against this backdrop, analysts suggest a strong upside may be imminent for Bitcoin and altcoins. BeInCrypto contacted Brickken market analyst Enmanuel Cardozo D’Armas, who said Bitcoin could retest $90,000 soon.

“If China’s M2 keeps growing, it could give Bitcoin a push upwards, based on what we’ve seen before. Right now, Bitcoin’s at $85,000, and if M2 keeps increasing, we could potentially see a retest of $90,000,” Enmanuel Cardozo D’Armas told BeInCrypto.

This target aligns with yesterday’s US crypto news, where Blockhead Research Network (BRN) analyst Valentin Fournier highlighted the $90,000 target for Bitcoin price.

Meanwhile, Cardozo D’Armas articulated that China’s M2 money supply is projected to hit record levels by the end of 2025. In his opinion, more money floating around in China could mean more people willing to invest their cash into riskier assets like crypto, especially now that China’s stance is shifting positively.

According to the analyst, the $90,000 threshold is an important resistance level, necessary to conquer before a run-up to the $100,000 milestone. However, whether this is attainable by mid-year remains debatable amid macroeconomic jitters.

“But it’s not a sure bet, as there are a lot of things that could affect the markets at the moment. If the Fed cuts rates in May or June, as some expect, that could add more fuel. On the flip side, if trade tensions with China or crypto regulations tighten again, we might not see those targets hit,” the Brickken market analyst added.

Indeed, there remain concerns about Trump’s tariff chaos and China’s retaliatory stance. Amidst these uncertainties, investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

The macro context also includes a hawkish Federal Reserve (Fed) stance from Jerome Powell, which ruled out any imminent rate cuts.

Reports also indicate that China is liquidating seized cryptocurrencies through private firms to support local government finances amid economic struggles.

Cognizant of these factors, Cardozo D’Armas explained that while China’s M2 can contribute to Bitcoin’s upward momentum, especially in bullish times, it is not the only thing crypto market participants should pay attention to.

Despite the bullish prediction, traders and investors should brace for macroeconomic headwinds, among other elements, which could temper any near-term gains.

Charts of the Day

This chart suggests Bitcoin may follow China’s M2 trend toward a price surge.

This chart shows a historical correlation where rising M2 often precedes altcoin price surges.

“Altcoins don’t run until liquidity breaks out. It’s time,” crypto analyst TechDev quipped.

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $316.25 (-0.30%) |

| Coinbase Global (COIN) | $175.03 | $175.02 (-0.009%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.51%) |

| MARA Holdings (MARA) | $12.66 | $12.68 (+0.16%) |

| Riot Platforms (RIOT) | $6.46 | $6.46 (+0.009%) |

| Core Scientific (CORZ) | $6.63 | $6.65 (+0.29%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply