Bitcoin drops from $88,300, testing key support at $84K–$85.9K.

U.S. government moves $8M in BTC, raising market speculation.

Holding $84K support could push BTC toward $92K–$95K.

Traders anticipate volatility as BTC faces a crucial moment.

Bitcoin (BTC) is experiencing a sharp pullback after failing to sustain its recent bullish momentum. The leading cryptocurrency surged to a high of $88,300 but faced strong resistance, leading to a decline that now places it at a critical support level.

At the time of writing, BTC is trading at $85,420, reflecting a 2.12% decline over the last 24 hours. BTC’s 24-hour trading volume stands at $41.24 billion, with a market capitalization of $1.69 trillion and a market dominance of 60.86%.

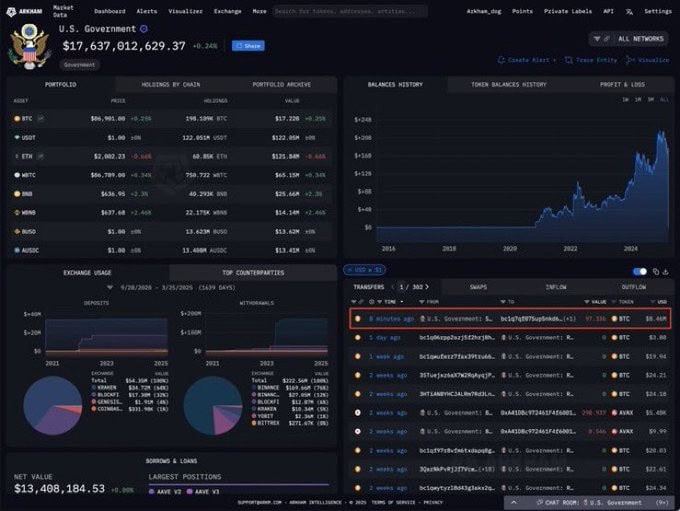

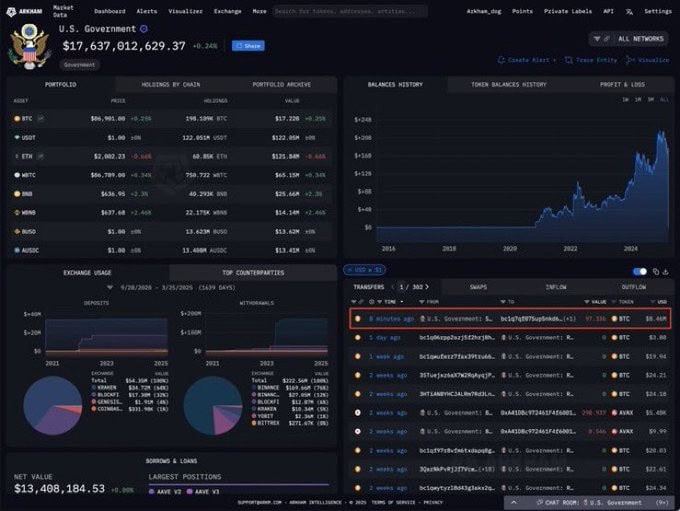

U.S. Government Moves $8M in Bitcoin

On-chain data reveals that the U.S. government has initiated a transfer of $8 million worth of Bitcoin, fueling speculation about a potential market impact. Historically, such movements have sparked uncertainty, as government-linked transactions are often associated with asset seizures or planned liquidations.

Bitcoin’s Fate Hinges on $84K Support Level

Crypto market expert Crypto Candy emphasized that Bitcoin is currently retesting the $84K–$85.9K zone on the daily timeframe after reclaiming this level for the second time. If BTC maintains this support, it could trigger a fresh bullish wave, potentially pushing prices towards the $92K–$95K range. However, a breakdown below this zone could signal further downside.

The Bitcoin market remains at a critical juncture. Holding the $84K–$85.9K range is crucial for maintaining bullish momentum, while losing this support could invite further selling pressure. Traders and investors are closely monitoring price action, with volatility expected in the coming days.

With uncertainty in the air and government-linked BTC movements raising questions, the crypto market remains on high alert. Stay tuned for further updates as the situation unfolds.

Related Reading | Hyperliquid Announces $JELLY Bail Out Plan After $4M Trade Crisis

Leave a Reply