- Bitcoin’s rise in short-term holder activity signals potential price growth, with $100K as the next major target.

- Historical patterns show that increased short-term holder activity often precedes significant Bitcoin price surges.

- Bitcoin’s current price range suggests a possible breakout; surpassing resistance could trigger a move toward $100K.

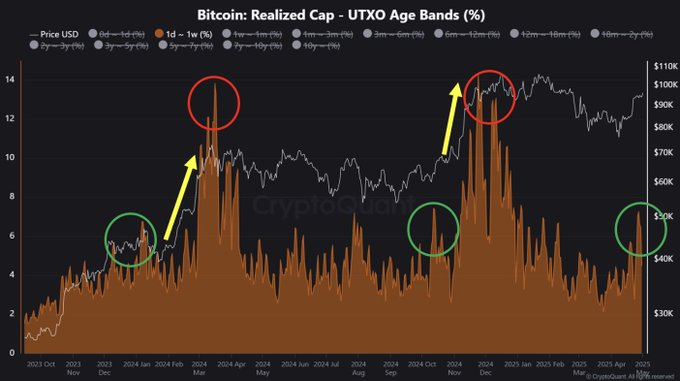

Bitcoin is expected to experience strong price growth in the near future, according to CryptoQuant’s recent analysis, which reveals patterns similar to those observed in early 2024. The platform shows a dramatic increase in short-term holder operations, which indicates that market prices could jump. The rise in short-term holder behavior in Bitcoin’s markets typically precedes substantial price changes, which indicates Bitcoin could surpass the $100,000 level to begin an upcoming bull market.

Source: X

Bitcoin entered temporary price boosts during both January and October 2024 after its short-term holder base expanded. The rise in short-term wallet usage by holders with one to seven days of holding time ended in significant price rallies, which affected BTC and all major altcoins. New upward movements for Bitcoin seem possible based on CryptoQuant’s data analysis, which shows this activity pattern re-appearing on the market.

Bitcoin Poised for $100K Surge

Price surges in cryptocurrency markets are directly proportional to activity among short-term investors who hold their assets for one week or less. Throughout history, increased flows of short-term holders served as an early alert that accumulation was starting, which usually precedes significant price surges. The current trend suggests that BTC has a strong probability of reaching $100,000, which would trigger a new robust bullish trend.

Daan Crypto Trades warns that Bitcoin exists within a constrained and unstable trading zone. The current price position protects against lower highs, but analysts believe the market shows signs of impending liquidity extraction. A BTC price rise above essential resistance zones without any rejections would signal the start of an extended bullish trend. The market interprets a swift price rejection as BTC clearing its path for temporary market retreats.

Source: X

BTC Trapped in Price Range

Bitcoin remained confined within the $83,000-$86,000 range during last week, which demonstrated its persistence to stay bound by recent trading patterns. Market participants stand ready with a pause until they identify undeniable directional cues. BTC has the potential to trigger a major market rally if it surpasses the existing resistance levels since it could propel prices toward the $100,000 mark.

Market sentiment appears to have shifted because short-term holders have become more active, yet market uncertainties persist. These market indicators draw close attention from traders because they may lead to BTC price growth in upcoming market periods. The cryptocurrency market could enter a new phase of upward movement when BTC manages to cross the $100,000 threshold during the ongoing trend.

Read More: Ethereum Gears Up for a $2,000 Breakout: Key Network Updates Driving Growth0

Leave a Reply