Key Insights:

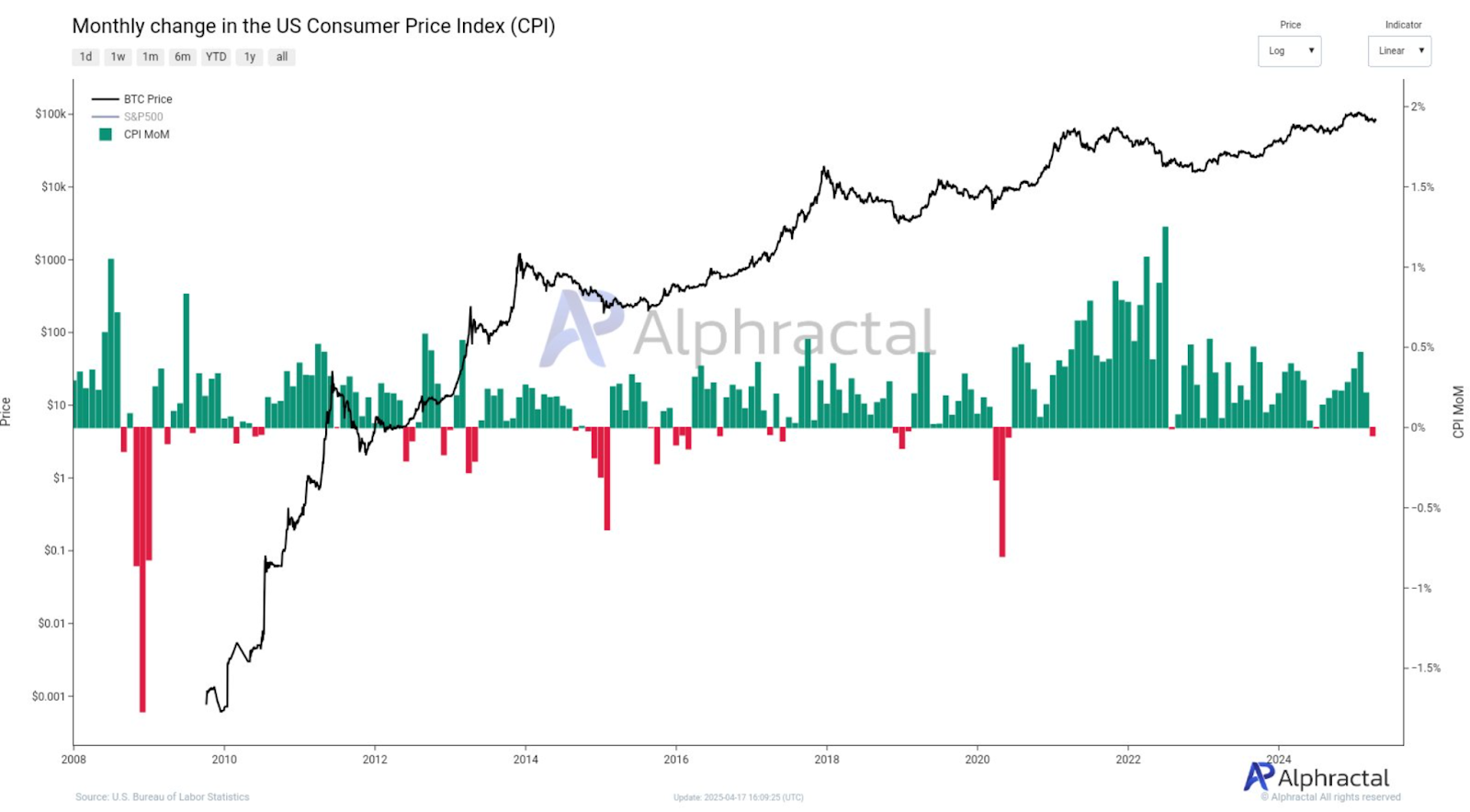

- U.S. CPI MoM falls below 0%, pointing to slowing inflation and possible early signs of deflation

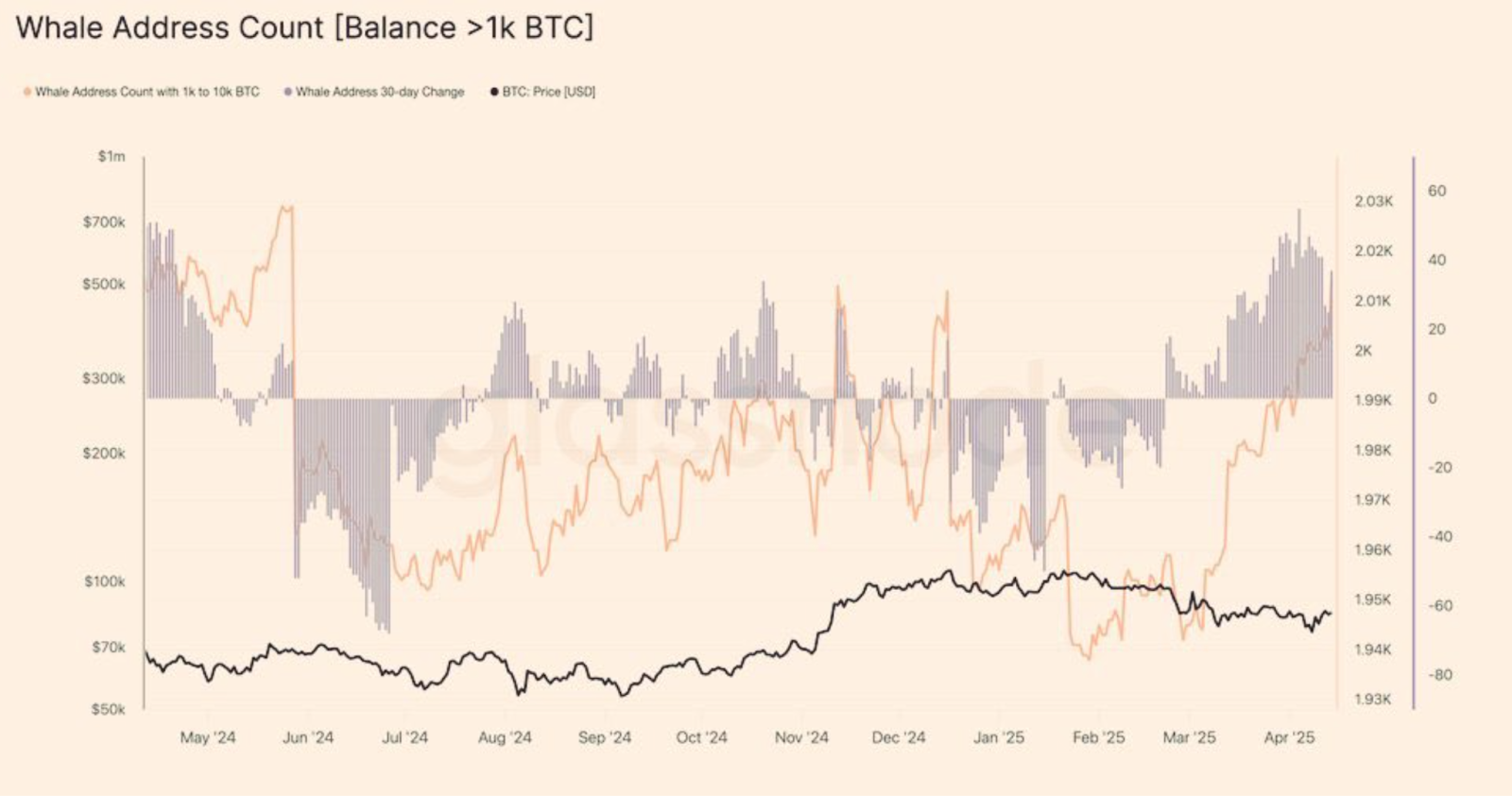

- Whale wallets holding over 1,000 BTC increase, showing large holders continue to accumulate

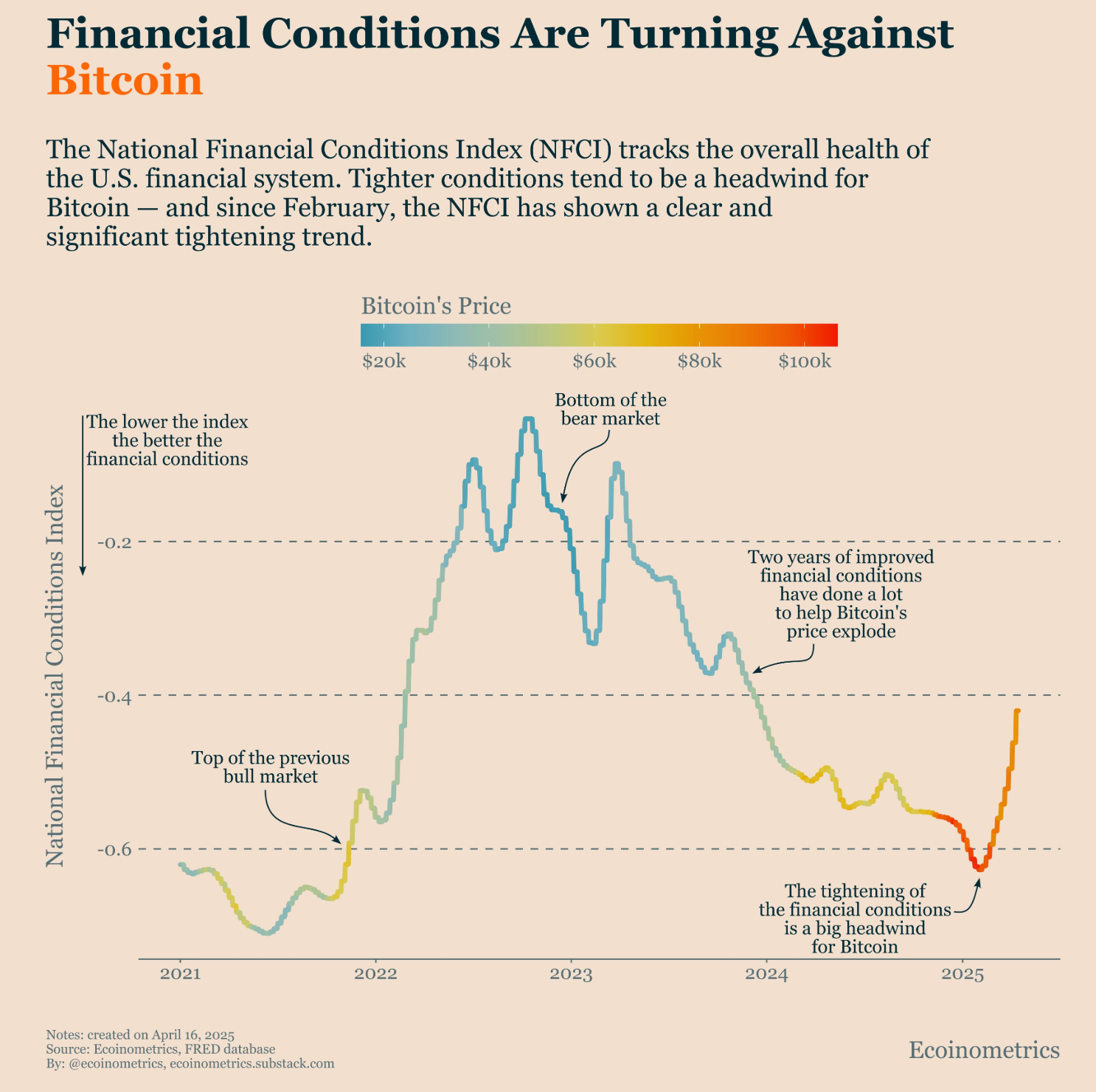

- Financial conditions tighten sharply since February, potentially limiting Bitcoin’s upward momentum

The U.S. CPI MoM is turning negative for the first time in years, and Bitcoin’s price is at a critical point. Meanwhile, on-chain data indicates that whales are increasing their accumulation, and the broader market could be weighed down by tightening financial conditions in the coming months.

CPI MoM Turns Negative

According to the U.S. Bureau of Labor Statistics, the CPI MoM figure for March 2025 was negative. Such a rare decline in monthly consumer prices either means inflation is slowing or deflation is beginning. The CPI MoM figure dipped below 0% for the first time since the brief deflationary shock in early 2020.

Negative CPI readings have historically coincided with local bottoms in Bitcoin’s price. A drop in the CPI MoM was also seen in late 2014 and March 2020, which coincided with Bitcoin entering accumulation phases, followed by increases. If this trend continues, Bitcoin may be entering a similar phase, but there is still room for further price volatility.

Investors may once again see Bitcoin as a store of value if inflation slows. A return to lower inflation could see capital flow to other assets as central banks are expected to keep their interest rates higher for longer.

Whale Accumulation Continues to Grow

Meanwhile, Glassnode data indicates a steady growth of whale wallets holding between 1,000 and 10,000 BTC. These addresses have increased from about 1,940 in March 2025 to more than 2,020 by mid-April. The 30-day change in whale wallet count has also been positive, with a few days having a net change of over 20 new addresses.

This increase suggests long-term holders are accumulating during Bitcoin’s sideways price action between $70,000 and $100,000. Historically, similar accumulation phases have preceded major upward moves, as seen in 2020.

The growth in whale addresses signals growing long-term confidence, even as retail participation remains muted during consolidation.

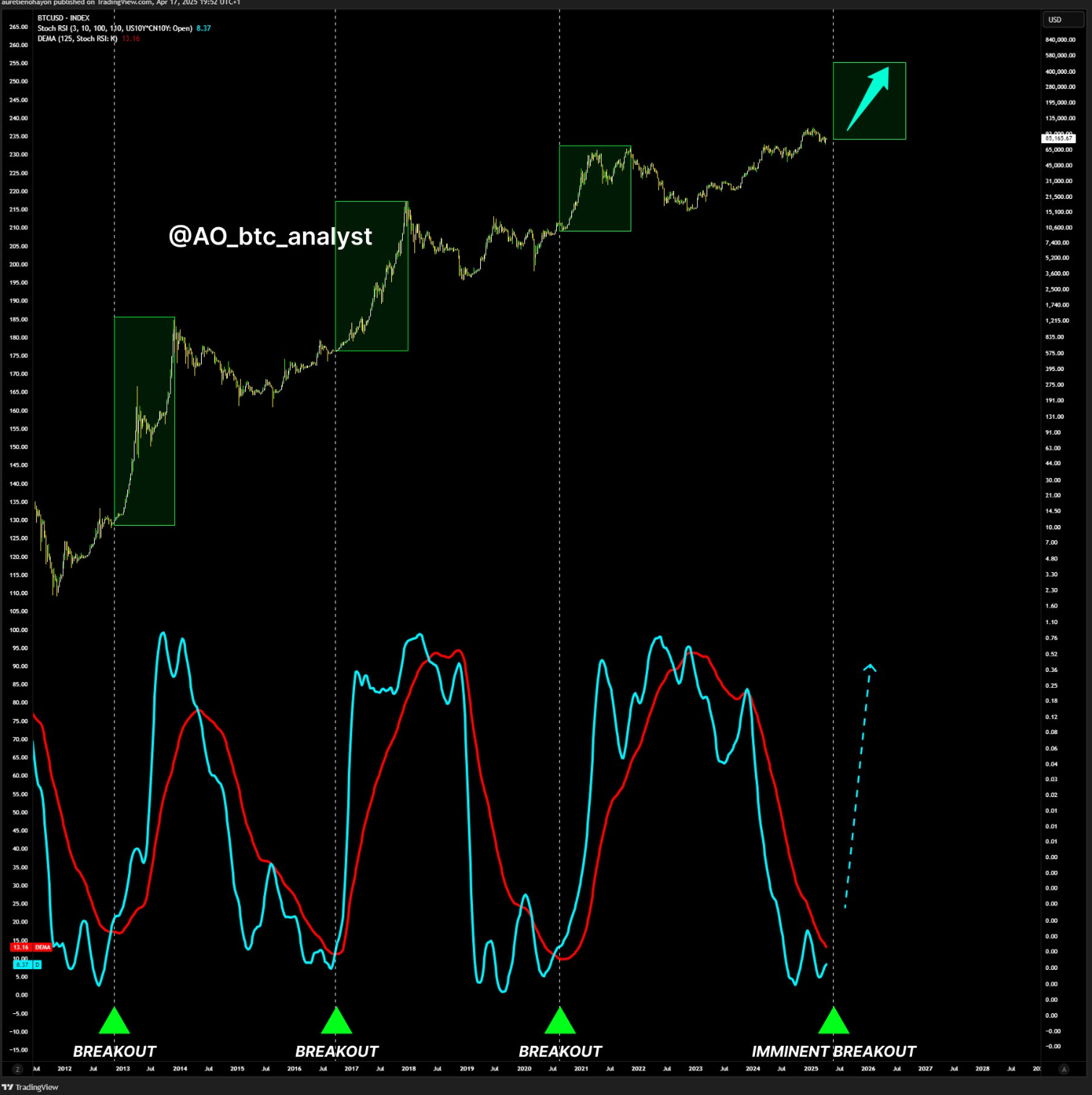

Technical Chart Points to Breakout Pattern

The Bitcoin price cycles are compared to momentum indicators in a long-term Bitcoin momentum chart shared by Ao_btc_analyst. Over the last decade, the blue momentum line crossed above the red line from a low level on four occasions. All of these events were tagged as a ‘breakout.’

The previous breakouts were in 2013, 2017 and late 2020. Bitcoin always entered a strong upward trend each time. This setup is building again, as the current chart shows. The analyst has called an “Imminent Breakout” and the indicator lines are once more near a crossover zone.

While timing is unknown, the regularity of the pattern across cycles lends credence to the idea that Bitcoin is getting close to the beginning of a new bullish cycle. Looking at historical price data from previous cycles, these momentum shifts have happened just before multi-month rallies.

Financial Conditions Are Tightening

Meanwhile, the National Financial Conditions Index (NFCI) is also rising again, indicating tighter credit markets and less liquidity. The index has risen from around -0.55 to about -0.35 since February 2025. Higher readings of NFCI usually indicate a growing difficulty in obtaining credit and increasing stress in funding markets.

This could weigh on Bitcoin price, as tighter conditions reduce liquidity and limit investor risk appetite. Bitcoin’s rally between 2023 and 2024 was partly supported by falling NFCI levels and improving credit access.

With financial conditions tightening, Bitcoin may need stronger catalysts—such as institutional inflows or macroeconomic easing—to continue its upward trajectory. Whale accumulation remains a bullish signal, but broad market participation could slow.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Leave a Reply