- Investors’ confidence in Bitcoin ETFs appears to have returned as they deposited over $100 million on Thursday into the sector, following a brief dip midweek.

- BlackRock and Fidelity were the major players with significant ETF inflows, and rising open interest is a sign of increased activity and speculation in the market.

- Although there were positive inflows, a negative funding rate indicates the need for cautiousness as some traders are betting on a possible fall in Bitcoin’s price.

On Thursday, Bitcoin ETFs recorded a positive change after more than $100 million was invested. Wednesday saw a swing the other way, when $169.87 million was withdrawn from them, marking the only negative of the week.

But since Monday, Bitcoin ETFs have had a net inflow of $15.85 million, and it seems like the market might be coming to a strong close. ETF investors are gradually displaying confidence this week, with the strong rebound in institutional investments.

According to experts, their massive Bitcoin ETF purchase is also a reflection of renewed interest in a long-term view of Bitcoin, even though short-term technical indicators are mostly mixed.

Bitcoin ETF Inflows is Proof of Investor Confidence

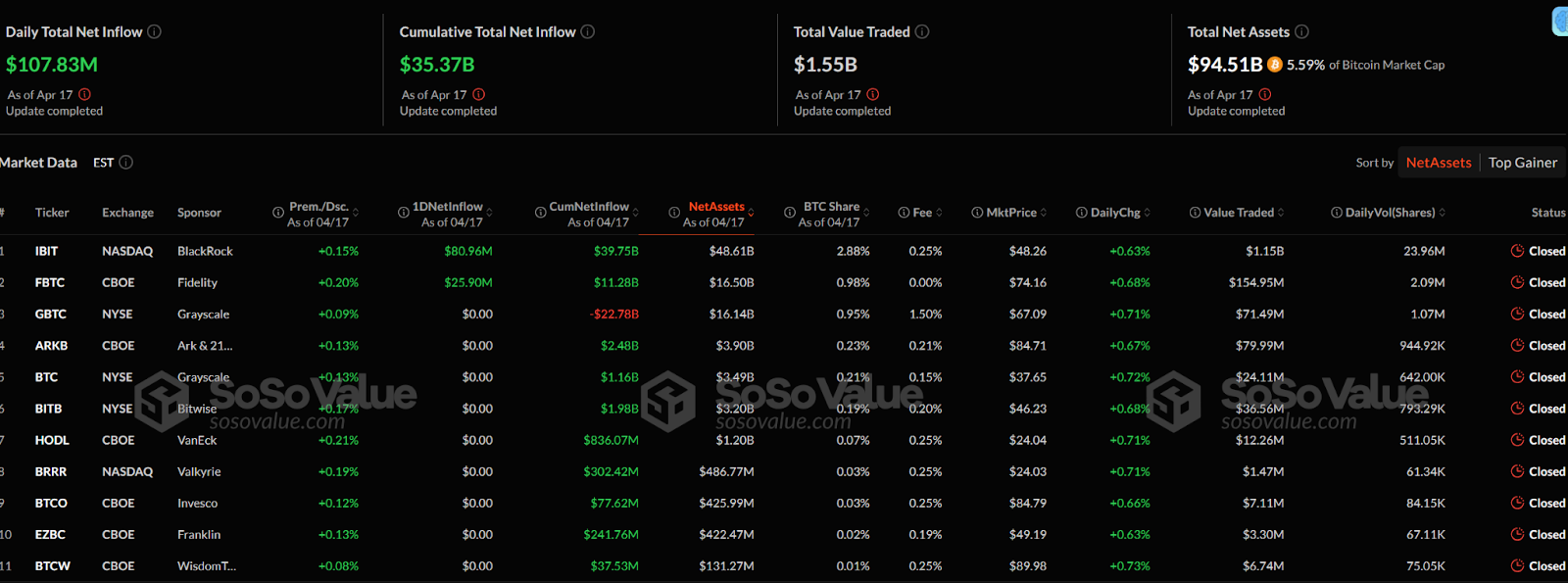

Recent data shows that BlackRock’s Bitcoin ETF, IBIT, had the largest daily net inflow of $80.96 million on Thursday. This increased its net inflow to a substantial $39.75 billion. Fidelity also had its Bitcoin ETF, the FBTC, following closely behind with a net inflow of $25.90 million.

Source: SoSoVaue

Bitcoin price has surged by 0.1% within the last 24 hours to a current value of $84,497. This is also accompanied by a noticeable rise in its trading activity, as shown by an increase in its Open Interest.

The BTC Futures Open interest is $54.6 billion as of the most recently available data, which is a 2.01 percent increase from the previous day. Any rise in BTC’s price coupled with its open interest means that more and more traders are entering this market.

Key Metrics Remain Mixed As Bitcoin ETF Buyers Return

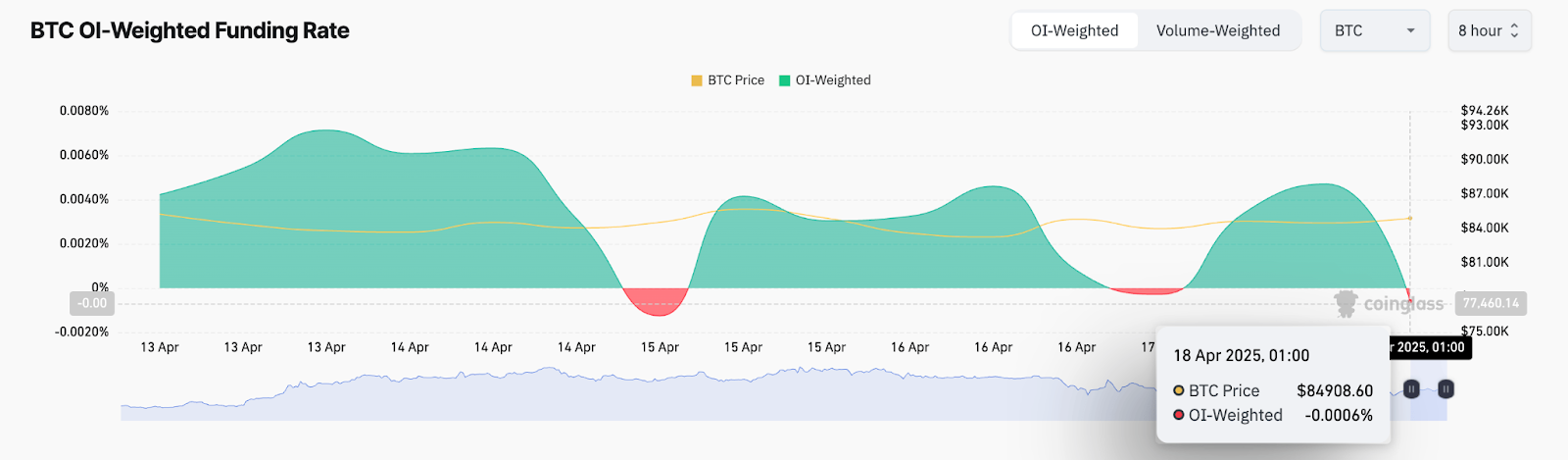

Interestingly, some other key metrics indicate that traders are not completely bullish on Bitcoin. The funding rate for Bitcoin futures has turned negative, meaning that traders are now paying those who bet on Bitcoin’s price to rise (long positions), since there is more demand for long positions.

Source: Coinglass

The funding rate at the time of writing is currently at -0.0006%, suggesting that there is a part of the market that is expecting a decline in Bitcoin’s price.

Leave a Reply