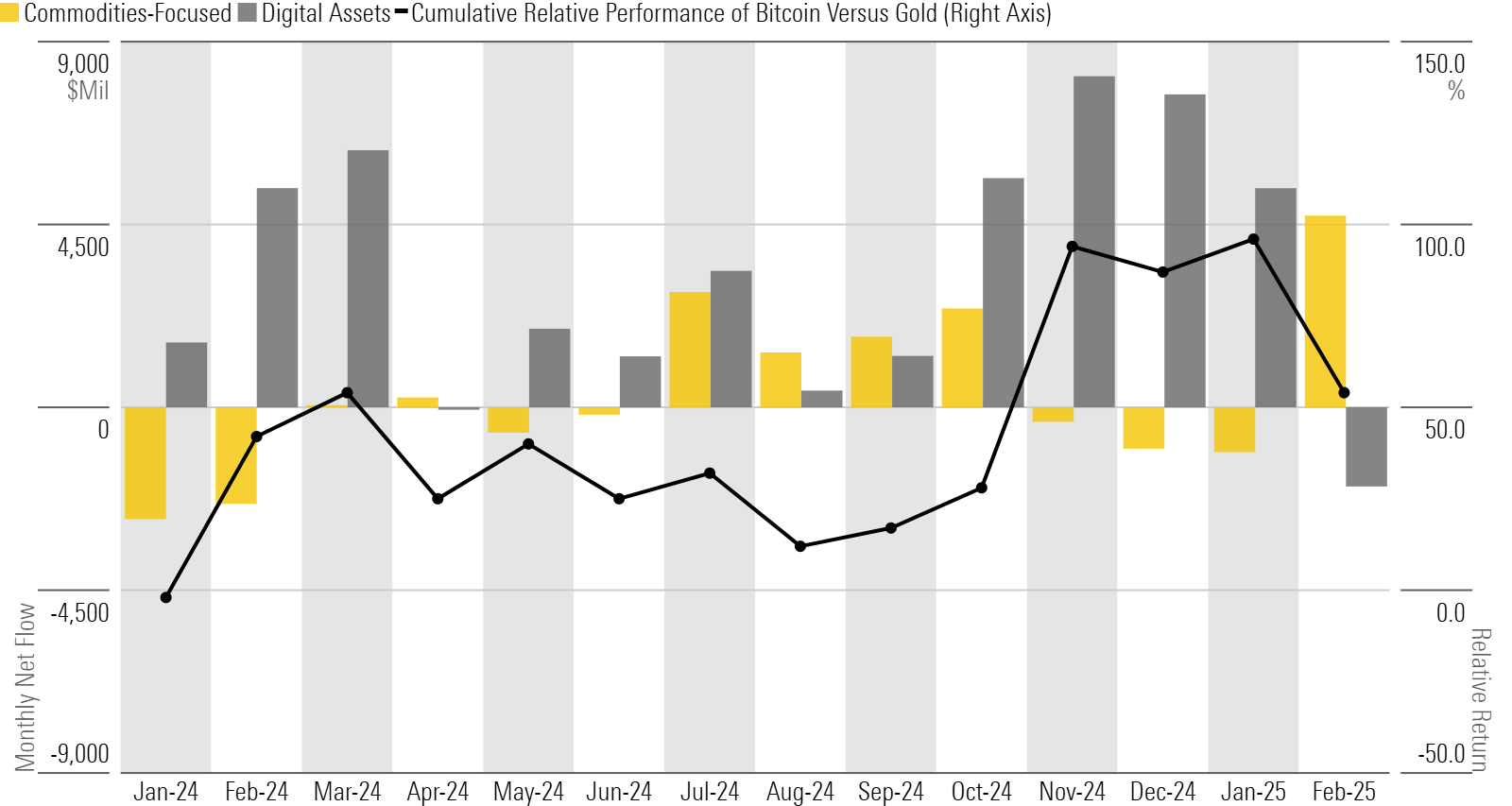

“Digital gold” fell out of favor in February, but real gold did not.

After investors seemingly tossed gold to the curb in favor of bitcoin, the shiny metal returned to favor at the expense of the digital asset. The commodities-focused category, which houses gold exchange-traded funds, took in $4.7 billion for the month (the most since March 2022). Digital-assets funds shed $1.9 billion as investors noted Bitcoin’s 17.4% slide in February.

Bitcoin ETFs to Keep an Eye On

Fidelity Wise Origin Bitcoin FBTC bore the brunt of the pain with $1.2 billion of outflows. IShares Bitcoin Trust ETF IBIT, the largest in the category, stayed nearly flat. However, news from BlackRock could give that fund some momentum. The asset manager announced on Feb. 28 that iShares Bitcoin Trust ETF would join select model portfolios. Still, a return to high-flying inflows will likely hinge on whether bitcoin can rebound.

SPDR Gold Shares Posted Strong Returns Before Flows Followed

SPDR Gold Shares GLD hauled in $3.4 billion in February to lead the charge for gold ETFs. Investors were slow to reward gold for its recent returns: SPDR Gold Shares climbed 36.4% over the 12 months entering February, a stretch in which its category collected just $3 billion.

It seems that investors needed turbulent stock markets for gold to reach their radar.

Editor’s Note: This article is adapted from the February fund flows and ETF flows commentaries.

The author or authors do not own shares in any securities mentioned in this article.

Find out about Morningstar’s editorial policies.

Leave a Reply